defer capital gains tax uk

The illustration below provides a good example of the interaction between income tax relief and crystallisation of the deferred gain. You sell a property or investment at a profit then reinvest that money into an Opportunity Zone Fund within 180 days.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

If you made a 2 million dollar profit over one-fifth of that would be paid out to the IRS because of capital gains taxes.

. 100000 Capital Gain Invested via EIS. Capital gains tax CGT is levied on capital gains made on disposals. Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous periods accounts.

See the Introduction to capital gains tax guidance note. In other words 10 of the original gain is tax-free. Capital gains refers to the overall profit you made on your asset.

Depending on the nature of the asset disposed of this can result in the individual paying capital gains tax CGT at 20. ER is subject to a. Deferral of exit charge payments for Capital Gains Tax.

Malcolm Finney explains when and how capital gains tax can be deferred on gifts of assets standing at a gain. If you sell all the EIS shares in March 2019 the whole of the deferred gain. If the funds are left in the.

Deferring Capital Gains Tax on UK property disposals. This measure deals with the deferment of payment of Capital Gains Tax by certain UK resident trusts or non-UK resident. Deferring the property gain individuals.

It is possible to defer capital gains tax by exchanging 1031 exchanges for property sales. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether. Can You Defer The Capital Gains Taxes On The Sale Of The Investment Property.

A Tax-Deferred Cash Out is a way of structuring the sale of an asset so that cash equivalent to a large fraction of the net selling price typically 935 can be received at closing while you. NOW - Defer Capital Gains Tax. There are various capital gains tax reliefs which an individual can utilise to defer the capital gain on a property disposal until a.

You defer a gain of 50000 arising in 2014 to 2015 by subscribing 50000 for EIS shares issued on 10 March 2014. You can defer payment of CGT by re-investing the capital gain into an. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares.

From there your Capital. In overview ER provides a lower capital gains tax rate of 10 as compared to a standard rate of 20 on gains arising when disposing of qualifying assets. Firstly its important to note that there is no general provision allowing CGT on a residential property to be avoided by simply reinvesting.

If the funds are left in the QOF for at least five years the basis increases to 10 of the deferred gain.

Capital Gains Tax How Can You Avoid Paying Capital Gains Tax Marca

Real Estate Tax Tips Youtube Real Estate Sales Real Estate Estate Tax

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

The Capital Gains Tax And Inflation Econofact

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

From Exchange Timing To 1031 Rules To Details On Debt Read Our Top 1031 Exchange Misconceptions For 2020 Ipx Misconceptions Capital Gains Tax Paying Taxes

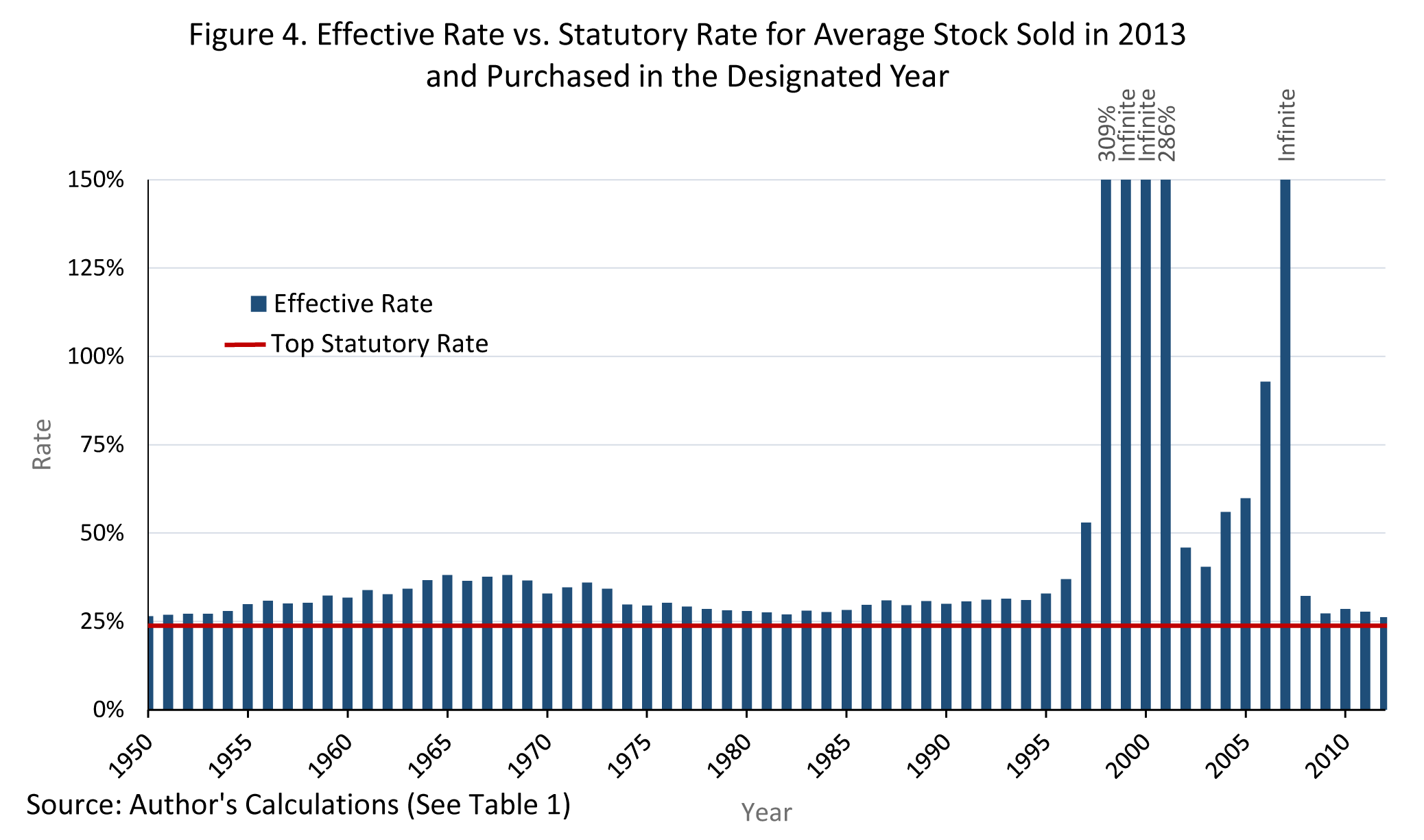

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

Managing Tax Rate Uncertainty Russell Investments

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

Capital Gains Tax What Is It When Do You Pay It

Ways To Potentially Defer Capital Gains Tax On Stocks

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Pin On Blogging Lifestyle Best Of Pinterest Group Board

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats